Why alcohol-free, THC-infused beverages are the #futureofalcohol

September 27, 2019

Read Time

4 min

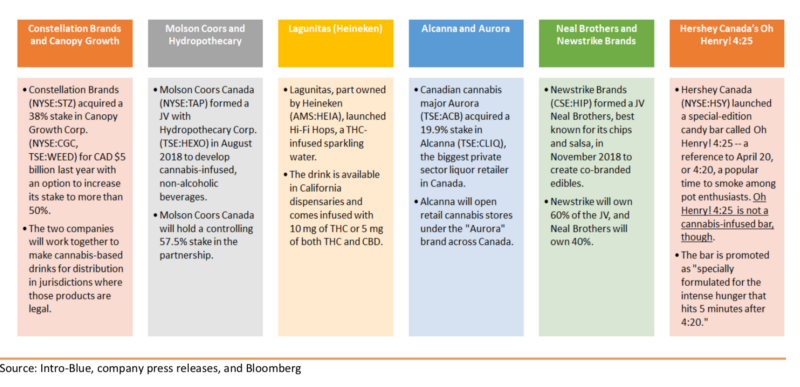

Since Constellation Brands’ (owner of Modelo, Pacifico, Corona, etc.) $4bn investment last year into Canopy Growth, a Canadian cannabis company, I have become fascinated by the potential threat that weed poses to alcohol. New joint ventures and investments between alcohol and cannabis businesses are giving rise to a new category of THC-infused, alcohol-free beverages that are forming the conversation for HNGRY’s next episode about the #futureofalcohol.

There are a number of macro trends happening right now in both cannabis and alcohol spaces that I believe are creating the perfect storm for a surge for products like Lagunitas’ HiFi Hops, Two Roots, High Style, and New Frontier.

Sober movement and better-for-you alcohol-free spirits

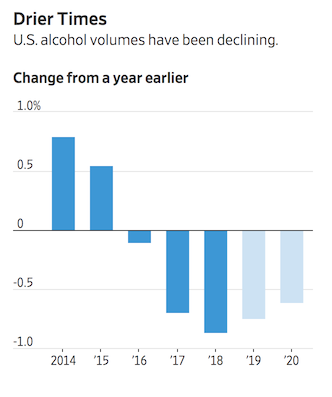

This is leveraging Nasim Taleb’s theory of the dictatorship of the small minority: it only takes a small number of virtuous people who are intolerant of something (e.g. Kosher, vegan, etc.) for society to adapt to their needs. Since 1980, pure ethanol consumption has declined by 16% in the US. Over the last three years, alcohol volumes have been in steady decline, reaching nearly -1% last year.

On top of this, there is a rising health-conscious sober movement that still wishes to socialize, hence the advent of alcohol free spirits like Seedlip (recently acquired by Diageo) and Kin. Hip restaurants are leveraging these new spirits to form mocktails that can be sold alongside regular spirits, ensuring that lone sober millennials can still clink glasses with their friends without feeling left out. It’s akin to the rise of Beyond and Impossible Burgers popping up at fast food chains nationwide- they may not be the best selling items, but they create a draw for newly health-minded consumers. The non-alcoholic beer category, while super tiny, is growing 8% annually and THC-infused beer companies like Two Roots are already selling their non-alcoholic versions at big box retailers like BevMo! with the hopes of driving them to a THC-infused purchase at a dispensary.

The next layer of this trend would be lower ABV spirits like Haus and hard seltzers like White Claw, Truly, etc. but I won’t dive in there too much because “hot girl summer” is officially over. Let’s just say that younger people are getting smarter about their consumption and realizing that drinking is seldom worth the hangover.

Cannabis cafes

We’re about to see a host of new cannabis consumption lounges pop up. Next week, Lowell Farms will launch Lowell Cafe, the first restaurant to sell cannabis alongside regular food, in West Hollywood. These spaces will define how cannabis can be consumed socially in public as a potential substitute to traditional bars.

First time tokers

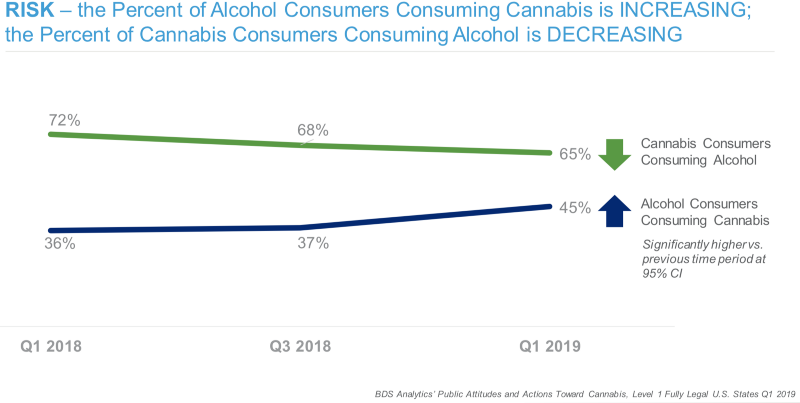

According to BDS Analytics, there is an increasing trend of alcohol users consuming cannabis while cannabis consumers simultaneously drink less alcohol. On average, about one in every five consumers of cannabis report reducing their booze consumption by a half. A study over a 10 year period of states with medical marijuana programs found a 13% decrease in alcohol sales in those counties.

The “vaping crisis” and edible legalization in Canada

October 17 marks the date that edibles will become legal in Canada, hitting dispensary shelves by the end of December. Molson Coors, through their joint venture with HEXO, is already ahead of this trend and plans to launch its mysterious Truss Beverages line this year. This will be a breeding ground for other alcohol companies to test the THC-infused beverage market, preparing for legalization in the US.

I don’t have to add on the vaping crisis in the US, but let’s just say the growth projections for edibles look a lot better in light of all the health concerns around vaping. According to ArcView Group and BDS Analytics, the edible market in the US and Canada is projected to reach $4.1bn by 2022 (32%+ CAGR), stealing a decent share from traditional flower sales in that timeframe.

Better onset times through nanoemulsion of THC

Normal edibles can take up to two hours to metabolize through your liver and into your bloodstream. Newer nanoemulsion technology allows better delivery system of THC by doing that work outside the body by processing THC into tiny water soluble droplets that can enter the bloodstream, skipping the liver, and go straight to the blood-brain barrier. The result is an onset time that is quicker than edibles and just shy of a typical alcoholic beverage.

In conclusion…

As Canada legalizes edibles, consumers shift towards healthier alternatives to alcohol, and cannabis consumption lounges come online, we’re starting to form a full picture of what a post-prohibition society might look like in the US. Big beer conglomerates who don’t start testing in Canada now may find themselves grossly overpaying for growth in the future, just as they did with craft beer four years ago.