Read Time

7 min

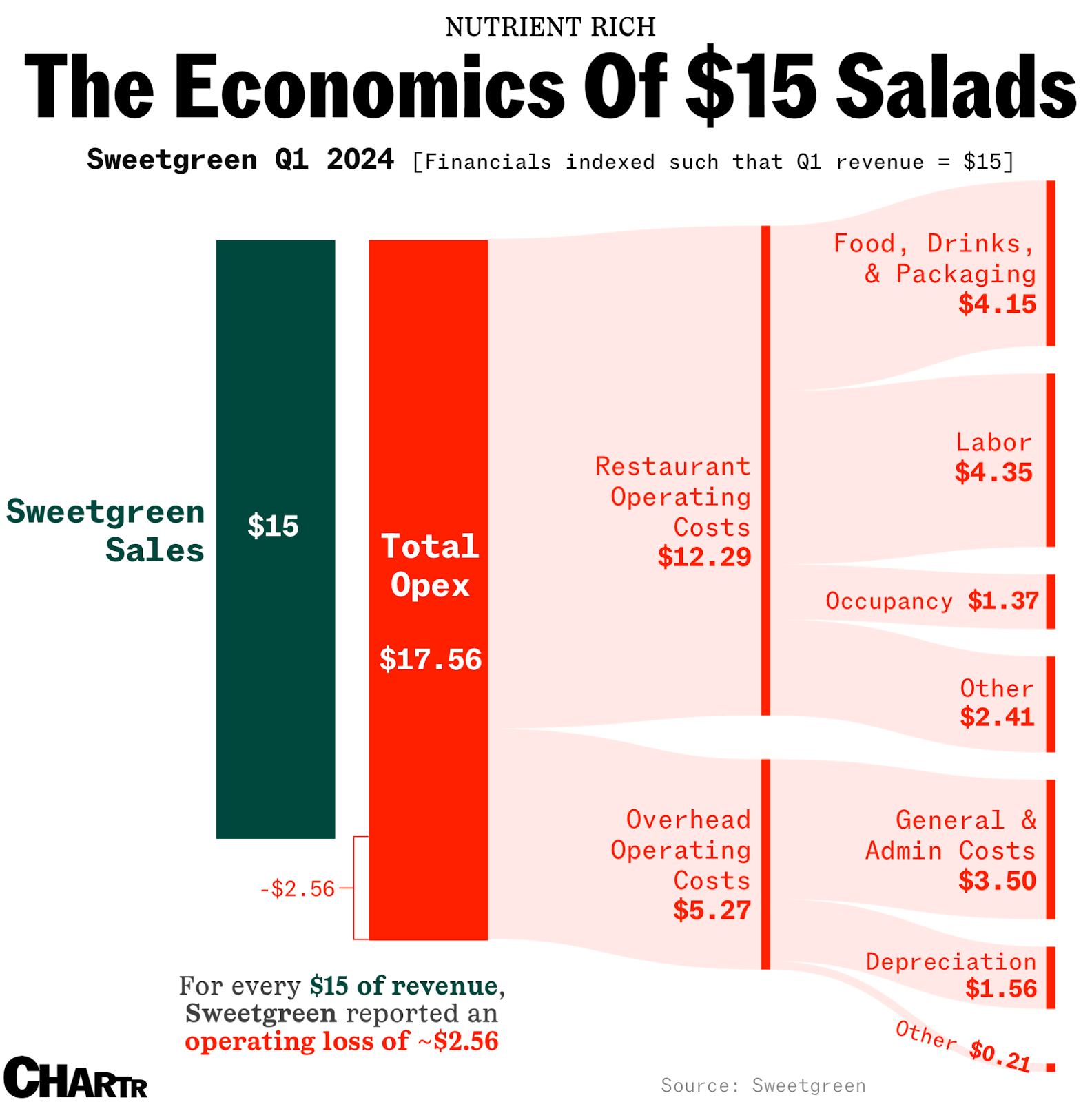

Sweetgreen is currently trading at a ~125x FY25E EV/EBITDA multiple as its stock surged as high as 44% since its Q1 earnings thanks to higher revenue and adjusted EBITDA guidance for the remainder of the year. Over the past year, management has been beating the drum on its Infinite Kitchen rollout in two suburban stores, and it seems as if the market is finally rewarding the company for the automation’s potential to reduce its labor costs by about a third. While the brand still remains unprofitable, it is expanding margins as it grows revenues with new store openings despite flat AUVs. In the next six months, it has an ambitious goal to retrofit 3-4 urban restaurants with the Infinite Kitchen while opening 7 new automated stores of the projected 23-27 locations slated for the year. But what are the key questions we should be asking when it comes to thinking about automation’s role to transform Sweetgreen’s business?

Subscribe to continue reading

Sign up now for HNGRY Trends to read weekly stories like this and join the community of hundreds of food tech industry insiders from CloudKitchens, Uber, DoorDash, GoPuff, and more.

Already a member? Log in