Read Time

7 min

When it comes to retail, data is king. But of all retailers, grocers have historically been labeled the biggest laggards to e-commerce, as demonstrated by their nail-biting after Amazon purchased Whole Foods three years ago. Fast forward to a week ago, Amazon announced that its mysterious Amazon Fresh format of larger retail stores would feature its smart shopping cart known as Dash Cart, leaving the press scratching its head to understand the key drivers behind the move.

Many believed it highlighted the physical limits of its Just Walk Out technology, which relies on a hybrid of sensors and cameras to charge a customer when she places an item in her bag at smaller Amazon Go convenience stores. Others referred to the move as “silly” and “one of the worst ideas in the history of Amazon,” calling it the “equivalent of a GPS system that used to sit atop car dashboards circa 2005.” But what critics may have overlooked is that while these self-checkout carts are indeed designed for shopper convenience, fully-equipped with Android touch screens that can pull up your Alexa shopping list, they more importantly serve as beacons for highly coveted “path data” used to examine how consumers move through the store as they make purchase decisions. Imagine blanketing the floor of a grocery store with paper and drawing a path with a crayon attached to the front wheel. That treasure trove of data can be used to determine everything from the ideal floorplan that maximizes sales down to the demographics of the most trafficked aisles. Path-related research has also been deployed in shopping malls to study how consumers move between stores. To get a glimpse of the future of this technology, we can look at the past.

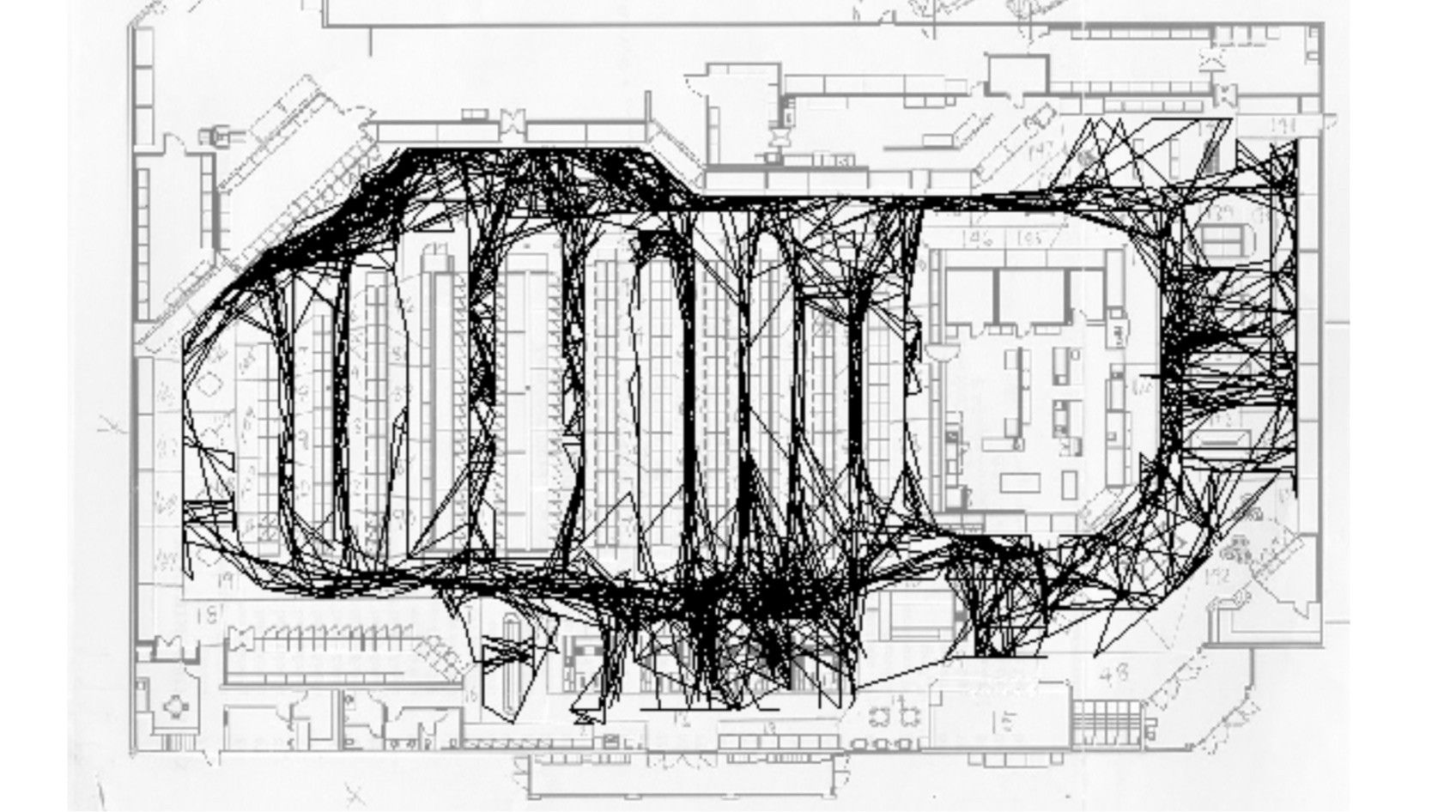

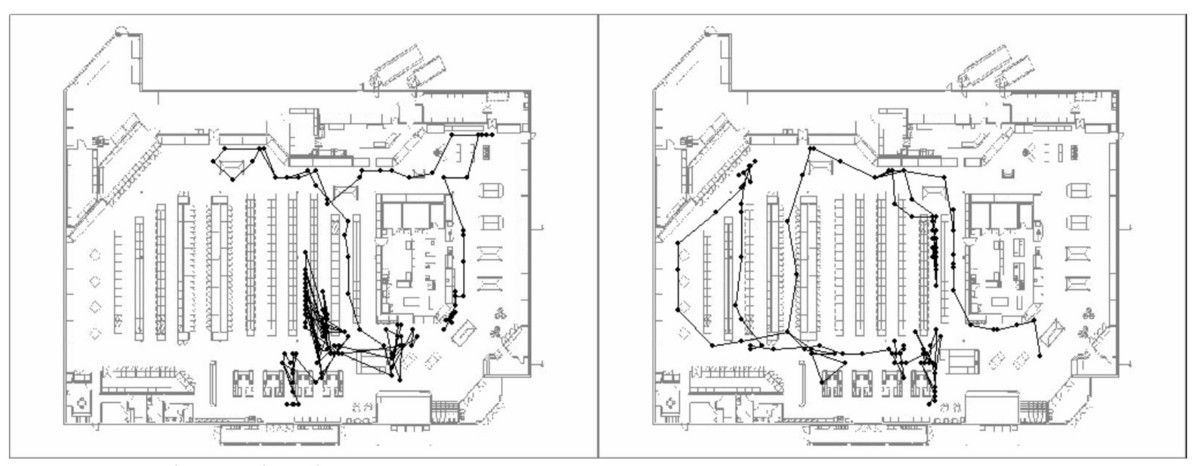

Fifteen years ago, Wharton School of Business professors Peter Fader and Eric Bradlow analyzed anonymized data from 1,000 grocery shoppers’ carts wired up with Sorensen’s PathTracker RFID system at an undisclosed US retailer. The team analyzed 14 canonical path types across short, medium, and long trips, seeking to cross-validate widely held psychological beliefs around shopper behavior. What they found was that contrary to popular opinion, shoppers don’t systemically shop up and down aisles. Instead, many dart in and out of aisles to get the products they need, returning to the “racetrack” of the store — the aptly-labeled perimeter frequented by all types of shoppers. Others resemble a range of wanderers who like to window shop, purchasing across a wider variety of categories, or a customer who could be struggling to find the right products. They also studied the “licensing effect,” the idea that when a shopper buys a healthy product like salad, that subsequently gives them the license to indulge in a product like ice cream. As it turns out, cart path data supported this habit. Additionally, the researchers found that 30% of all grocery trips are wasted, concluding that rearranging merchandise can create a more efficient shopping experience optimized to entice customers to spend more money within a fixed time frame.

“The grocery store today is exactly the same as the grocery store 20–40 years ago,” said Fader in a phone conversation with HNGRY. “[Amazon] can really upend the layout of a grocery store without being beholden to the traditional ways of doing it. The patterns we saw are just as applicable today as they were 15 years ago.”

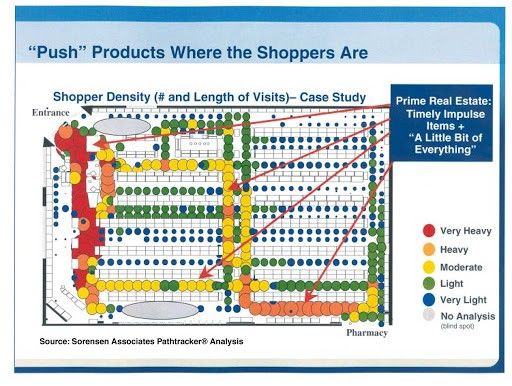

Like many of its product lines, Amazon is far from a first-mover to smart grocery carts. In 2008, Sylvain Perrier helped Loblaw’s in Canada and Food Lion in South Carolina deploy CONCIERGE, a smart cart system designed by Springboard Retail Networks. The company installed battery-operated tags in its carts and Ultra-Wideband receivers in each store’s ceilings to triangulate the location of a cart within about three feet of accuracy. One grocer that struggled with its seafood sales used path data to uncover that nearby shelving and display cases prevented shoppers from navigating that particular area. Perrier looked at the data and suggested they move the shelving by 4–5 feet, causing a 22% increase in sales. But he thinks that’s just the tip of the iceberg.

“If you know where these carts are going and where people are spending time, you could prove this is my best aisle,” explained Perrier, who is now CEO of Mercatus, an integrated e-commerce grocery fulfillment platform. “That’s like selling Super Bowl time in one aisle and PBS in another.”

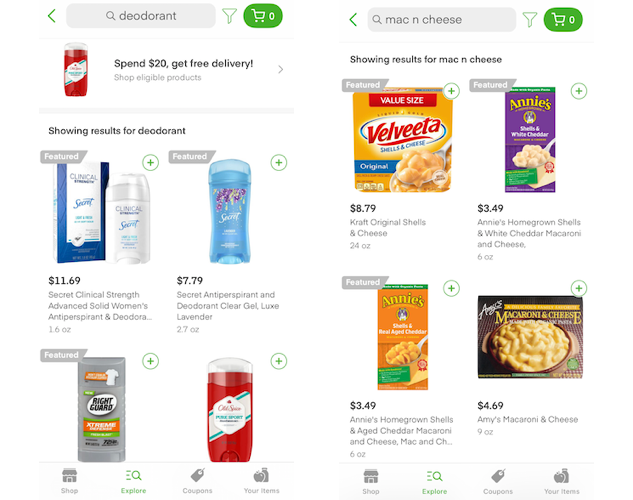

Perrier believes that instead of traditional retailers who sell yesterday’s shelf labels or floor stickers to CPG companies, Amazon could open up an auction for brands to feature their products in its most valuable aisles. One example he provided was for Axe body spray deodorant.

“Axe is bought by moms for their teenage sons. If Amazon can say to them here’s the best place to sell your products and here’s your price point, here’s your threshold, do you think Unilever will jump up? That’s data Unilever doesn’t get from the average retailer today.”

Fader agreed, adding that he could see Amazon creating an integrated media buy for CPG brands that spans both online and offline retail. He thinks the opportunity for CPG advertising far surpasses the potential for targeted advertising and coupons based on a shopper’s cart.

“Amazon knows that among their many futures is to be an advertising company. That idea of being able to use this info to know what they should charge for shelf space is brilliant. That by itself will bring it more value than cross-selling,” he said.

Similarly, Instacart’s CEO Apoorva Mehta has publicly referred to his platform as the “AdWords for grocery” and counts the top 25 CPG brands as advertisers on its platform. On an April call with Credit Suisse, Mehta explained that prior to Covid, there was no data pipeline between traditional retailers and CPG brands to share real-time inventory data, causing shortages within the supply chain. The startup scrambled a team of engineers to set this crucial link up.

Caper, a New York-based startup with $14.2mm in funding has piloted its smart cart with Sobeys in Ontario, Canada as well as C-Town, Brooklyn Fare, and Pioneer in the US. CEO Lindon Gao told HNGRY that Amazon’s announcement has accelerated deployment timelines for many of its retail partners. Its main draw is its ability to increase personalization while creating a checkout and contact-free experience for shoppers. According to its website, the startup claims it can increase basket size by up to 18% through its smart recommendations tailored at basket content. For example, it can see that a shopper added ground beef, tomato sauce, and dried pasta, recommending parmesan cheese along with a promotion. Its built-in store map can even guide the customer to the recommended item. The startup has been collecting cart path data anonymously but says its retail partners have yet to utilize it for item placement.

While traditional grocers struggle with analyzing granular shopper data and last-mile delivery, technology companies like Amazon and Instacart can afford to lose money as they set their eyes on creating advertising marketplaces.

“Amazon’s goal is not to win at grocery, Amazon’s goal is to win you the consumer. It’s a paradigm shift. Traditional grocers are thinking about basket size and dollars per square foot,” said Perrier. “The reality is quite frankly: we as consumers and businessmen bitch about Amazon for doing exactly what we know it’s possible to do.”