Faster Than Amazon: Deep Inside an Underground Robotic Grocery Store

January 07, 2020

Read Time

5 min

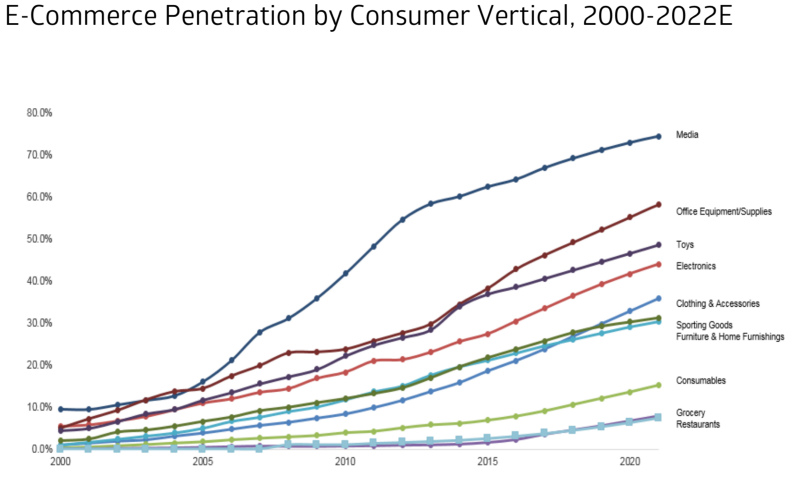

According to the UN, nearly 70% of the world’s population will live in dense metropolitan cities by 2050. If New York City’s 1.5 million daily packages is any example, today’s urban infrastructure is breaking at the seams as e-commerce penetration grows and delivery times shrink. In the US, groceries are the last vertical to be revolutionized by e-commerce. Today, just 3% of total grocery spending occurs online. In the next two years, FMI/Neilsen expects online grocery penetration to skyrocket to 13% of total grocery sales, or ~$100bn. Small-scale warehouses colocated in existing retail sites or parking garages offering 1hr delivery times, known as micro-fulfillment centers (MFCs) pose a potential solution and are coming to a major city near you in the near future.

Ever since Amazon acquired Whole Foods, grocers have been looking for technology solutions to stay competitive, building robotic Amazon-like fulfillment centers dedicated for online grocery delivery. The first iteration of these partnerships is evidenced by Kroger’s investment into 20-year-old, UK-based Ocado. Its warehouses are as large as 375,000 square feet, cost $55mm to build over 2–3 years, and are located on city outskirts. The next iteration of startups like Takeoff, Fabric, and Alert Innovations occupy a small fraction of the size, located inside existing retail sites or parking garages, and optimized for the “scooter-able” last mile of delivery (think Mopeds). While two-hour AmazonFresh delivery is now included as part of Prime membership in 20 metropolitan markets, it has a lot of room for optimization. There are challenges around relying on the speed of human pickers, reconciling e-commerce inventory with Whole Foods retail inventory, as well as efficiently serving the last mile of delivery to customers. Similar to its normal package congestion, AmazonFresh drivers must sometimes construct makeshift racks to hold delivery orders on the street while they sort through and deliver each order on a particular city block.

“What are underutilized spaces in cities that have reasonable rents that can enable two hour delivery of almost any item to a consumer?”

But what if Whole Foods was built in 2020? Over the holidays, I visited Fabric’s first grocery facility inside of an underground parking lot in the heart of downtown Tel Aviv, Israel. Beginning this month, the ~18,000 square foot center will exclusively fulfill orders from Rami Levy, the largest grocer in Israel. My immediate emotional response was equivalent, if not more jaw-dropping, to my first visit to a CloudKitchens warehouse a year ago.

Inside, robotic pickers whiz around three temperature-controlled rooms that stock 6,000 unique product SKUs from fresh produce to frozen pizzas to non-perishable goods. The average order is picked in four minutes and the entire facility requires four staff and two managers.

As shown in the video below, goods are housed in vertically-stacked bins, retrieved by a two-axis robotic system that places them on ground robots that bring each bin to a human who then bags each order into a tote. The tote then gets placed on a conveyor belt where drivers pick up each order.

Today, Rami Levy is quoting 2hr delivery times, but the vision is for Fabric to have enough coverage within a given city to get that figure down to 10 minutes. Unlike its competitors, Fabric operates a “fulfillment as a service” model where it is paid a percentage of each order. Chains pay Fabric an advance for every center that is later paid back once it reaches breakeven from the site’s operations. Fabric says its sites are designed modularly to fit a wide variety of footprints and ceiling clearances. They can scale vertically or horizontally inside existing retail or as dedicated centers like the subterranean, 11-foot high Rami Levy site.

While online delivery is currently unprofitable for grocers like Rami Levy, its CEO expects that Fabric’s automation will turn that around by cutting his processing costs in half. Rami Levy’s legacy online operation employs 350 humans who can pick 8–14 orders per day. The chain has signed a five-year exclusive agreement with Fabric to launch 11 more locations by July 2021.

Back in the states, Shoprite, Albertsons, Stop & Shop, and Sedano’s have built centers inside their existing stores with the help of Takeoff Technologies. The Rami Levy site is the second Fabric facility following its 2018 launch with SuperPharm, Israel’s largest pharmacy. That site occupies roughly a third of the Rami Levy footprint and cost ~$2.9mm (10mm NIS) to build. The company has recently opened offices in NYC and, according to the video below, seems to be eyeing Boston and Chicago as it works to launch its next center in Brooklyn. Meanwhile, Amazon is launching its own brand of grocery stores optimized for delivery and pickup, recently leasing over a dozen 20,000–40,000 sqft spaces inside of Los Angeles strip malls.

Like REEF and CloudKitchens, Fabric sees an $80bn opportunity in underutilized parking garage supply in the US. “People are consuming transportation as a service, rather than as an asset. If I don’t own a car, I don’t need to park it,” said Aleph VC investor Michael Eisenberg in the marketing video above. “What are underutilized spaces in cities that have reasonable rents that can enable two hour delivery of almost any item to a consumer?”

Look deep inside, deep deep down inside.

If you enjoyed this article please sign up for the free HNGRY newsletter here.